The Best Gold IRA Companies of 2023

You’ll also pay a one time set up fee, which averages $100. This coin is mailed in a wooden box with a certificate of authenticity, and it isn’t IRA eligible. Secure Your Future with GoldBroker: The Ultimate Precious Metals Investment Guide. You can get started with Noble Gold by filling out an online IRA setup form. Bars are identified by size, refinery and serial number for example: 100 oz. ” Christopher Albin “From the moment John called me I felt a sense of honesty. This can pose challenges for individuals who may not wish to sell their silver holdings or who want to maintain the tax advantages of holding silver within an IRA. The staff there will provide you with the information needed to set up an IRA account yourself. It is important to look for a company with a solid reputation and legitimate business practices. The gold IRA company will cover all costs associated with transporting your order to the depository of your choice as long as your IRA has the necessary funds. There’s a very good chance the type of mortgage you’ll need is on Wells Fargo’s list. Please note that the lifetime RMDs exception does not apply to Roth source amounts in your retirement plan.

Things to Consider When Choosing a Silver IRA Company

They are considered a reliable dealer of precious metals IRAs, although customers should remain vigilant regarding possible fraudulent activities. The business earned a coveted “A+” rating from the BBB in 2010. In addition, it is important to make sure that the gold IRA rollover lender is properly licensed and regulated by the state or federal government. Experience Unparalleled Wealth Security with Patriot Gold. 83Minimum IRA Account: $25,000Eligible Precious Metals: Gold, Silver, Platinum and Palladium. I was a little worried with moving my 401k but I had done my research and knew what I wanted. Here are some common reasons that people invest in precious metals, such as gold and silver.

Store your gold in an IRS approved depository

Invest in Your Future with Birch Gold and Enjoy Financial Security Today. Therefore, you should consider your financial goals, budget, and preferences to find the best option and make a wise decision if you want to diversify your portfolio. Experience Unparalleled Quality and Value with Augusta Precious Metals Shop Now. The custodian will also provide the individual with information about source the performance and value of the metals. A gold and silver IRA is a type of retirement account that allows investors to hold precious metals such as gold and silver. This customer focused approach to serving investors has earned Goldco Precious Metals near perfect reviews on trusted platforms such as Trust Pilot and Consumer Affairs. Goldco provides guidance to investors regarding important decisions and legal issues related to precious metals. The representative we spoke with informed us that there would be a flat, $180 annual fee once the account was opened. Many people who choose to invest in a gold IRA are using funds they acquired while using a traditional IRA or company managed 401k. In summary, working with a broker or custodian is essential for setting up and managing a Silver IRA. Learn why a Precious Metals IRA from Rosland Capital can potentially help protect your savings from market volatility. The company will also assist you in extending traditional retirement accounts into a precious metals IRA. When you deal with American Hartford, you will get all the fees waived off for one year. It has earned a five star rating when it comes to customer satisfaction, and it makes complete sense it’s one of the most reputable silver IRA companies out there.

The best gold IRA companies

RC Bullion is also one of the most trusted gold IRA companies, with a long standing reputation for providing quality products and services. Bars and larger quantities of precious metals present potential as long term assets. 999+ fineness, like the 1 oz. However, finding a legitimate loan lender is crucial to ensure the safety and security of your investment. With your personal financial goals in mind, the Augusta Precious Metals team ensures a smooth and clear transfer process with no additional IRS fees. Self Directed Accounts. Iridium IRA Account: 1. You must follow IRS guidelines and use IRA funds to purchase gold and silver from an approved vendor. During the 2008 financial crisis for example, the stock market dropped by approximately 50% while gold gained more than 25%. Do your research and find the best company to work with – one that offers a variety of gold options, is upfront about all of their fees and has a positive reputation in the industry. On the downside, they are very expensive to manage and are subject to strict guidelines set by the IRS.

Required Minimum Distribution Calculator

9950 pure, silver must be. 2 billion in custody. Even though there are multiple options available for precious metals IRAs, it’s essential to choose a reliable one. The process of opening one of these accounts is fairly straightforward. As for its gold selection, all of its coins and bars are IRS approved. This is why many investors flock to gold during periods of inflation. When it comes to understanding and managing risk, and knowing the importance of diversification that can be had with a precious metals IRA, Red Rock Secured has been a solid choice for our readers. By creating an account, you are agreeing to the Terms of Service and the Privacy Policy. Your custodian is most likely only providing you with the melt down valuation and not taking any buyback premium into account when valuing your assets. The predecessor business to Equity Trust Company was established in 1974 and the IRS approved as a custodian in 1983. And lastly, the following quotes about affiliate sites were taken directly from an online complaint forum.

Personal

Certain types of investments are specialized in some gold IRA companies. With this behavior, Red Rock Secured clients will be more comfortable asking questions regarding precious metal individual retirement accounts as the financial team guarantees they will listen. The advantage mutual funds and ETFs offer above actual holdings is they allow more flexibility when trading and are easier to liquidate ends. When it comes to silver investments within an IRA account, one has many products to choose from. 3 Best Customer Service: American Hartford Gold. If we had a need for another loan, we would not hesitate to contact Mark. 999+ fineness, like the 1 oz. Please let us how we can help you. Once you understand the transaction, your representative can initiate the process in just a few minutes. You can’t access your gold until you turn 59½ without incurring a penalty. Discover the Quality and Value of Augusta Precious Metals Today. Silver IRAs also carry lower maintenance and transaction fees than stocks or other investments, making them an affordable option.

Bullion Exchanges

Precious metals have historically performed well during times of economic turmoil, making them an attractive investment option for those seeking stability and security. Plus, with an A+ rating from the Better Business Bureau, a 5 star rating on review platforms like Google and Trustpilot, recommended by Bill O’Reilly, Rick Harrison, and Lou Dobbs, and having been ranked the 1 Gold Company by Inc. 9 out of 5 stars based on 221 reviews. For new customers, they offer a seven day money back guarantee. Look for the facility closest to you that best meets your needs/budget. They also offer competitive prices and a secure storage solution for investors. We will discuss each tip and show you why they are important. The company offers fair pricing on its precious metal sales and excellent customer service. They are one of the largest and most trusted custodians available for self directed IRAs. 5 Birch Gold Group: Low Minimum Investment. They offer a high level of customer service and low minimum investment requirements. Com, Goldco, The Royal Mint and Silver Gold Bull.

RC Bullion: Pros – Gold and Silver IRA

Conversely, how weighty would it be for your pockets to walk around with enough lead, aluminum, bronze, or copper coins to pay for your new house. We therefore recommend that you consult a qualified tax and/or financial advisor to gain an understanding of the risks involved in placing precious metals in your RSP and see the official Canada Revenue Agency website for information on the laws that govern RSPs. That being said, most of these companies charge a fee of at least $1,000 for the segregated service. Together with a designated IRA specialist, Allegiance Gold can help you determine if your account is qualified to be transferred. We’re here for you throughout every step of your vehicle loan journey. They are typically salespeople who are paid commissions based on the products they sell. After receiving the check, you have 60 days to deposit it in your new account to avoid paying taxes on the transfer. Their experienced staff offers sound counsel tailored specifically for each client’s unique situation, enabling them to confidently navigate the complexities involved with establishing these specialized accounts successfully – ultimately giving investors peace of mind knowing their hard earned money is safe and secure within this tax deferred vehicle. The IRS strongly advises against attempting to store gold or other precious metals from an IRA in your home, as it is prohibited for all IRA types. With a traditional IRA, you’re limited to investing in stocks and mutual funds. With a traditional IRA, taxes are due with the action of withdrawing after retirement. Gold Alliance: A Trusted Partner for Your Precious Metal Investments. GoldCo is an ideal choice for those looking for a reliable and trustworthy gold IRA company. 1Eligible bullion includes U.

Poison hemlock was reported in a North Texas city Here’s how to identify the toxic plant

Customer service interactionsWhen you’re entrusting a company with your retirement funds, the most important thing is that you feel comfortable with them. Keep in mind that some companies, while expensive, offer services very much worth their price. Birch Group has partnered with two of the most reputable depository firms in the country, Delaware and Brinks Global, to ensure your precious metals remain safe. It is much more complicated than that. Oxford Gold GroupOxford Gold Group was founded in 2017 and is based in Los Angeles. What is the cost to start a precious metals IRA. Highest price buyback program. Canadian Gold Maple Leafs. Coins that don’t meet IRA eligibility, but are a cost effective way to buy the metals.

Precious Metals ETFs vs Precious Metals IRAs

The company offers several services to its customers, including free shipping, a buyback guarantee, and price matching. Augusta Precious Metals is the most trusted gold IRA company. Borrowers are able to quickly get access to additional capital through major lenders like SoFi, LendingClub, Upgrade and others. IRAs can invest in gold and other precious metals in several different ways. Does not provide legal, investment or tax advice. However, choosing the correct company to work with is crucial, so they should take some time before deciding. Furthermore, Augusta Precious Metals uses the Delaware Depository as a custodian for people’s products.

Gold Bars

These include Brink’s Global Services and Delaware Depository. Visit the Investment District. Exploring Precious Metals Investment. Discover the Gold Standard in Quality with GoldCo. This measure is intended to protect their customers. Very few companies maintain their own storage depositories, so most partner with third party depositories approved by the IRS for the secure storage of precious metals held in IRAs. Click here for a complete list of IRA approved precious metals. You worry about the volatility of the investment products in your existing retirement portfolio. In summary, investing in gold and silver IRAs can be a prudent investment strategy for retirement savings. Generally speaking, when the stock market is over performing, the value of gold is at a much lower amount. The following table summarizes recent Private Letter Rulings PLRs that relate to IRA investments in precious metals. Its exceptional quality of service can be seen through the glowing reviews it has attracted on its website and other online platforms. Buffalo Gold Uncirculated coins with no proof, plus more. In this guide, review the best gold IRA companies.

Michelle Trujillo

Grow Your Wealth with Birch Gold: Invest Now for Maximum Returns. You’ll need to have a custodian that specializes in such investments, as the Internal Revenue Service IRS only permits certain financial institutions to be used as custodians for IRA accounts. Augusta Precious Metals has solid customer reviews on many important platforms such as Google and Facebook, as well as other recognized review sites. The inclusion of precious metals within an IRA account can potentially offer the investor additional diversification and growth opportunities. At no stress to us and within the shortest time frame. You can only do it in a separate, special one called a self directed gold IRA account. The company also offers a variety of retirement plans such as traditional, Roth, and SEP. One of their few demerits is the high minimum deposit. This process requires a simple form to get in touch with your current custodian and request the funds be moved into your new IRA account. With a gold IRA rollover, investors can benefit from tax deferred growth and the ability to transfer funds from a traditional IRA to a gold IRA without incurring taxes or penalties. In addition, the company uses a flat rate fee structure, which can be a double edged sword.

4 Most Common Problems With gold and silver ira

Likewise it is perfectly fine to buy investment real estate, but your IRA cannot purchase your personal residence. Choosing an IRA company demands a good amount of thought and due diligence. The company’s experienced agents will guide you through each step of the process and ensure that you have all the information you need to make informed decisions about your retirement savings. This includes maintenance and their gold IRA storage and isn’t dependent on the size of your account. GoldBroker’s gold IRA experts are knowledgeable and can help you make the best gold IRA investments. All markets have risks associated with them. Each type of gold investment has its own set of benefits and drawbacks, so it’s important to do your research and consult with a financial advisor to determine which option is right for your individual needs and goals.

Top 1% Mortgage Originators

With Goldco, clients can also buy gold and silver. There are even some IRAs right now that allow for the storage of digital currencies like Bitcoin to further diversify your investments. Individuals should consult with their investment, legal, or tax professionals for such services. This recognition from industry experts and customers alike is a testament to Augusta’s exceptional service and performance. The IRS has a list of approved storage depositories. Nothing gives you more financial security than having physical gold and silver in your safety deposit box. The company has a highly experienced team of professionals who are dedicated to helping clients make the most of their investments. One of the key benefits of investing in a Silver IRA is its tax advantages, which are especially beneficial for those in higher income brackets. Other than that, Noble Gold will hook you up with a financial advisor to make you understand which investment is right for you. Their experienced staff is dedicated to helping you make informed decisions about your investments. Invest in Silver with GoldBroker Security Guaranteed. Gold IRA custodians are responsible for providing financial guidance and overseeing the investments of gold IRA accounts. Click here to apply for wholesale pricing.

PRECIOUS METALS FORMS

Class aptent taciti sociosqu ad litora torquent per conubia nostra, per inceptos himenaeos. Platinum for inclusion in an IRA must have a minimum fineness of. Birch Gold is knowledgeable in the gold market and provides customers with detailed information to make the best decisions. No, the IRS requires that we send your gold or other precious metal directly to your IRA custodian, who will hold the metal until you decide to liquidate. A representative can help you decide what precious metal to buy for your gold IRA, such as gold, silver, platinum or palladium. The advantage mutual funds and ETFs offer above actual holdings is they allow more flexibility when trading and are easier to liquidate ends. Both options have pros and cons, and a bit of research is crucial when deciding which option better suits your investment plans and goals. The only variable is waiting on the client’s current IRA retirement account holders. Goldco Precious Metals offer different options when investing in precious metals.

Discipline

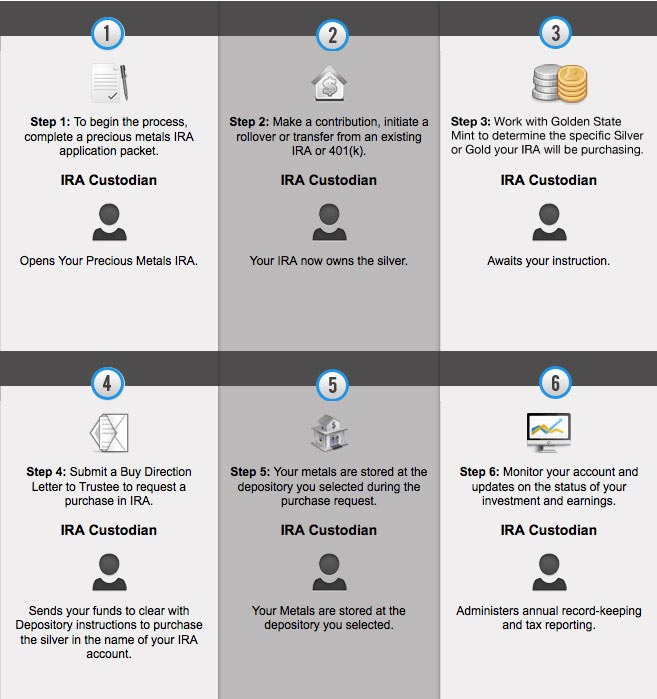

American Hartford Gold. To open a silver IRA, the person must go through a process. How Much Does It Cost To Get A Coin Graded In The USA. There is very little information available on their website regarding loan requirements and financing risks. These loans are designed for borrowers who are looking to flip, or resell, a home after renovations are completed, rather than renting it out. Therefore, the company needs to focus on educating its customers, whether directly through professionals or indirectly through info kits. Request your free guide or gold IRA kit from 2 3 providers, have them ship information to your home, and review their products and services. It offers several IRS approved gold products, including American Gold Eagle bullion coins, American Gold Eagle proof coins, gold bars and rounds, Canadian Gold Maple Leaf coins, Austrian Gold Philharmonic coins, and more. Live the Life You Deserve with Oxford Gold Group. They may not be used by anyone other than a duly licenced member firm of the Network. The company assists its clients in buying, selling, and storing precious metals for potential investment.