MODERATORS

You need to be aware of the fact that the website does not provide a price list. Users can create and customize a trading journal. Terms of Use Privacy Policy. It’s a business operated and owned by a family. A custodian must handle these investments. If you take physical possession of your precious metals for any reason, it is considered a distribution from your IRA, which is a taxable event and may be subject to the early distribution penalty. Rajkumar SM is a founder of SoftwareTestingMaterial.

Gold IRAs: A Post Financial Crisis Trend

If your account balance is less than $100,000, the best approach is to shop around and go with the provider that offers a balance between competitive fees, outstanding customer service, and a sufficiently ample portfolio of gold coins and bars to choose from. Or, consider reading this comprehensive Gold IRA FAQ section straight from Uncle Sam himself. Get insights on the precious metals market, metals investing and tips on how you can protect your wealth with precious metals. Bullion refers to bars or coins that are made from gold and are valued based on their weight and purity. Advantage Gold is one of the newer gold IRA companies, but it already has thousands of happy investors. I will continue to work with them for my metals purchasing. MC 3196; Lender License No. Used in real estate transactions, a hard source money loan is granted by individual investors or companies, not banks, because they are generally a last ditch effort and riskier. Researching gold IRA companies can be overwhelming. Don’t leave the fate of your financial future to chance.

Things to Consider Before Buying Silver with Your IRA

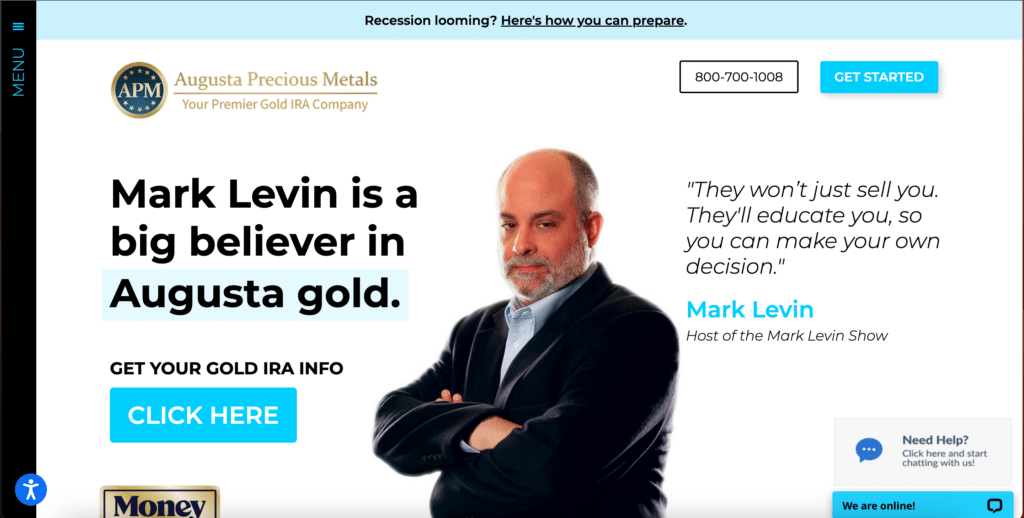

Augusta Precious Metals stands on three commitments: transparency, simplicity, and service. Below is a step by step procedure for buying precious metals stored with BullionStar for your IRA. Invest in all loans protected by either the Gold Trust or Provision Trust2. First, you must extensively study the market’s custodians and the various coins and bullions. You can read more about my referral links here. American Bullion’s fees are competitive, and they waive all expenses for the first year, making it an attractive option for investors. In addition, Silver Gold Bull lets you set up more than one precious metals account, and you can maintain an existing 401k or employer sponsored plan while setting up an IRA through the platform. American Hartford Gold: Runner up – Best Price for Bullion 4. Provided they meet minimum fineness requirements1, these metals can be held in a retirement account. A: To open a gold and silver IRA account, you will need to choose a reputable custodian or broker that specializes in precious metals IRAs. Investing in a metals IRA would have been able to offset losses on other investments.

LIQUID

It’s time to have a serious discussion about gold. The real goal is to diversify so that your overall wealth is not compromised by economic dangers and uncertainties like the kind generated by the 2008 financial crisis or the on going sovereign debt crisis in Europe. With its extensive knowledge of the silver market, the company can help you make the best decisions for your retirement. A precious metals IRA, also sometimes referred to as a Gold IRA or Silver IRA, lets you invest precious metals, including various types of silver bars and coins. Augusta Precious Metals has a decent collection of resources on its website. The value of the dollar will gradually decrease over time, and things will become more expensive. We work with these nationally recognized depositories. Setting up an IRA account to invest in precious metals is easy. You could hope and pray it all turns around – but that’s not a very solid tactic. With higher returns and a hedge against risk, it’s easy to see why this is a great option for those looking to grow their retirement savings. In a gold and silver backed IRA, investors can hold various forms of gold and silver, including coins, bars, and bullion. Grow Your Wealth with Augusta Precious Metals. However, setting up and running a gold IRA account requires understanding the legal requirements of buying and storing your precious metals safely.

Other Gold, Silver, Platinum, and Palladium Coins

Your gold IRA company should help you with the withdrawal process. And failure to make RMDs will be penalized. Highest price buyback program. You won’t pay any fees for life on a qualifying IRA. Thank you Mandi and Noble Gold. Noble Gold aims to stand out from other gold IRAs by inspiring trust. It is always wise to understand your decision before investing in a precious metal IRA. Read More of the post 170337Homebridge. Investing in gold can provide several benefits and applying for a loan is one way to use gold as collateral to access funds. ❌ Not fully transparent about the management team❌ Not rated by the BCA. Simply contact your gold company of choice and complete an Investment Direction. Please pass the chips and thank you for feeding our habit. Augusta garners the trust of its customers by responding promptly to their needs, giving them a full refund if they are not satisfied with their purchase, and keeping prices low.

How to Order

You should research carefully to ensure you are selecting the right company. These are paid by your SDIRA provider. When you create an account with New Silver you can begin your journey on FlipScout by browsing thousands of properties in your neighborhood to find a good deal provided by insights. With that level of assistance, Goldco is considered the best precious metals IRA company for first time precious metals IRA investors and would be applicants. A depository to safely store and insure your precious metals. Inflation End Game: “Everyone Pays and No One Benefits”. Augusta Precious Metals offers gold backed IRA options that are secure and safe, providing peace of mind to investors. This is because the IRS has strict regulations in place that require all precious metals, including silver, to be stored in a depository that meets their criteria. When deciding to invest in a gold backed IRA, it is important to consider the type of gold that can be held in the account.

GoldCo: Cons Best Gold IRA Companies

Investing in a gold and silver IRA rollover is an effective way to diversify your retirement portfolio. They have a wide selection of silver coins and bars, and their rates are competitive. That fulfill the requirements of an IRA, as determined by the Internal Revenue Service. Additionally, the firm uses international Depository Services IDS for storage. What is a self directed IRA. Another advantage of a Silver IRA is the potential to hedge against inflation.

Customer Support

You will then be a client of Equity, and will pay theappropriate fees for administration and storage. With an IRA approved silver, investors can benefit from the stability of a precious metal while still taking advantage of the tax benefits of an IRA. => Visit Goldco Website. Tools, calculators, and research functionality is limited as well. They are dedicated to helping their customers make informed decisions when it comes to investing in gold and silver. 555 12th Street, Suite 900, Oakland, CA 94607. With a gold IRA, you can take advantage of the many benefits of investing in gold, including diversification, security, tax advantages, long term growth potential, protection against inflation, and liquidity.

APMEX

Q: What is a silver IRA account. Nothing contained herein shall be construed as investment, legal, tax, or financial advice or as a guarantee, endorsement, or certification of any investments. Some account providers avoid charging this fee for large initial deposits. They have won numerous awards to solidify their reputation and integrity as an industry leader in the world of gold IRAs. Discover the Benefits of Precious Metals Investing with Lear Capital. The IRS has specific requirements as to the storage of precious metals. Birch Gold is knowledgeable in the gold market and provides customers with detailed information to make the best decisions. Spot prices are quoted in troy ounces, or about 31. Take The First Step Towards Financial Freedom With Noble Gold. Award winning “Best Gold IRA Company,” singled out by Money magazine and others. Only if you’re buying specifically for inclusion in an IRA.

Noble Gold: Summary Best Gold IRA Companies

Again, segregated storage means your metals have their place in the vault. Look for companies that have been in business for a while and have a track record of success. Augusta Precious Metals provides a very personalized approach. This option is known as the self directed IRA. Take The First Step Towards Financial Freedom With Noble Gold. You will need to complete an online IRA form to get started. If you do not consent to receive text messages and emails from Equity Trust and seek information, contact us at 855 233 4382. She is a past spokesperson for the AARP Financial Freedom campaign. Known for one on one educational web conference designed by on staff, Harvard trained economic analyst. If clients are looking for a company with a fantastic reputation, American Hartford Gold might probably be the best one. Q: What is a silver IRA account. Furthermore, each company is committed to providing the best customer service and guidance to their clients. We make efforts to present the best possible deals available to the general public, but we make no warranty that such information represents all available and existing products. When the stock market tumbles, even the so called “safest” mutual funds and bonds can take a hit, and retirement accounts can suffer greatly.

What is Goldco’s Process?

Augusta Precious Metals is highly rated due to their outstanding and reliable services. Investing in precious metals with a self directed IRA is easier than you might think. At today’s spot price, what will my total cost be for each coin I buy. They derive their value from the fact that they are limited in supply and finite in nature. Make them your first choice when looking to start investing in precious metals or if you are looking to conserve your wealth going forward. Patriot Gold Group offers a fast 24 hour account set up, allowing you to begin investing in precious metals in no time. Each of these companies has its own strengths and unique offerings, so it’s important to compare and contrast them to find the one that best suits your individual needs and preferences.

Gold

Oxford Gold Group is an outstanding choice for those seeking to invest in gold. With the help of the rankings, investors can easily compare the various gold and silver IRA companies and select the one that best suits their needs. In conclusion, the Birch Gold Group process is simple, straightforward, and accessible to anyone, even those who have no prior knowledge of precious metals IRAs. Discover Gold Investment Opportunities with GoldBroker. Unlock the Potential of Patriot Gold Club Now. Silver Has Huge Growth Potential. This is how we keep our reporting free for readers. Their value is due to various factors, including scarcity, industrial demand, and their function as a store of value. Like any investment, gold can go up or down in value. 1% in Q4 FY23; net exports and manufacturing surprised on the upside. We have built relationships with established custodians that have a fantastic track record from the Better Business Bureau and the flexibility to help you meet your specific retirement diversification goals. Self directed IRAs can be set up in three simple and quick steps at Goldco. “These guys are unbelievably good.

What are the rules for gold IRA?

In addition owning gold in an IRA can offer you significant tax benefits. They’re both valued per ounce based on the price of gold, but some believe coins are the safer choice. Buying silver bars at current market prices can provide a big return for those who resell it to vital industries around the world. Advantage Gold is a leader in gold IRA physical possession. Noble Gold offers a wide selection of gold and silver coins and bars, as well as a variety of other precious metals, that investors can use to diversify their portfolios. The coin is guaranteed to contain one troy ounce of 99. APMEX recommends discussing the details of your personal investment strategy with your IRA Custodian or financial adviser. Goldco was founded in 2006 and it stands out in a variety of ways, but providing exceptional customer support is one of the ways it has built a reputation for itself. Investing in gold and silver IRA accounts can be a smart move when planning for retirement. Make sure to compare several companies before making a decision to ensure you are selecting the best fit for your retirement goals. You have the right to change beneficiaries at any time by submitting a one paged form. You’re never too old or too young to start building or protecting your nest egg.

American Gold Eagle coins

Enter your email address and we will send you a link to reset your password. The fees for buying and selling gold are not tax deductible. For an accessible vendor of gold and other precious metals, we strongly recommend Augusta Precious Metals or American Hartford Gold. Alert investors who are concerned about a portfolio limited to paper assets have a much better option. They will then send you an Investment Direction form for your signature to authorize the transaction. Derivatives are hedge bets, which try to estimate the future values and reduce volatility risk. Discover Why Augusta Precious Metals is the Best Choice for Investing in Precious Metals. Portfolio diversification is essential because it allows investors to make sure that if one option fails, the other one will stabilize their assets. Or perhaps build your own from the ground up. When looking for the best gold IRA custodian, it is important to consider the fees, customer service, and security measures taken by the custodian. There are numerous reasons for doing so, but they all revolve around the benefits of such an account. Essentially, you are expected to spend as much as $300. Noble Gold works with other businesses, including suppliers of precious metals. Self directed retirement portfolios invested in gold are ideal for anyone who wants to diversify beyond conventional paper assets.

Michelle Trujillo

To get started you can contact a well respected metals firm like Rosland Capital, to select the exact precious metals you want to have in your IRA. The IRS permits the holder of a self directed precious metals IRA to hold of silver as an asset within their account while achieving the benefit of the tax benefits that are typically associated with such retirement accounts. Augusta Precious Metals doesn’t require you to pay any management fees if you are looking to open a self directed IRA account. In addition, always consult with your precious metals IRA specialist or tax advisor to ensure compliance with all applicable rules and regulations. Their expertise in the industry is unparalleled, offering customers a secure and reliable option for investing in gold. Any written or verbal communication should not be considered tax advice or acted upon as such. As with any type of purchase or investment, someone looking at starting a precious metals IRA should do their own due diligence and research. When you request it, you’ll also receive an exclusive offer for up to $10,000 in free silver to add to your investments. Vermillion Enterprises – THE BEST place to turn your silver into cash or turn your cash into a silver investment. Their customer service is top notch and they offer a variety of customer support options. Therefore, they’ll do everything they can to win them over.

Cons

Reaching out for the first time, connect with us using the below channels. When choosing the best gold IRA custodian, it is important to research the company’s reputation, fees, and customer service. The IRS does not allow for investment in “collectibles”, though. Augusta Precious Metals, American Hartford Gold Group, Oxford Gold Group and Lear Capital all provide a wide variety of gold IRA products, from coins to bars and rounds. Outside of this self serve option, more traditional customer support options are limited. However, people should remember they’re working for their long term future. Pacific Standard Time for assistance. After that, there are transaction fees that vary from one provider to the other.

Subscriptions

From Saint Paul, MN rated 5 stars on TrustLink. With a silver IRA, you can purchase physical silver coins and bars, or you can purchase silver ETFs or mutual funds. This means that you don’t need to make another initial deposit to get the ball rolling. 95%, and some investment choices for IRA include. These are a form of a Self Directed IRA, only your funds can be held in gold rather than stocks and bonds. The company’s commitment to providing the best customer service and their reliable and secure platform make them one of the best gold IRA companies in the industry. This fee includes insurance, storage, and access to an online account. Employee Time Clock – Track employee hours easily with the built in time clock feature included in Advantage Gold. Whether it’s because the most recent recession has inspired Americans to seek out more diverse types of retirement funds, or simply because families want more potential protection for their money, there is a lot of interest in precious metal backed retirement accounts today. We’ve worked with many of the best Precious Metals IRA Custodians, offering investment opportunities with our IRA eligible gold, silver, platinum, and palladium bullion. They also provide competitive rates and a variety of options to choose from. It’s important to note that there are specific regulations regarding the types of metals that can be held in a precious metals IRA, so it’s advisable to consult with a qualified custodian or broker to ensure compliance. Additionally, a custodian can provide valuable guidance and advice on managing your gold IRA investments. According to the company, most investors adhere to the following fee schedule.

Contact Us

By offering their clients the tools and knowledge they need to make informed investment decisions, these companies empower them to achieve their financial goals. That’s why many people turn to gold IRA companies for help. With an IRA approved silver, investors can benefit from the stability of a precious metal while still taking advantage of the tax benefits of an IRA. Goldco would have to be the best option in this regard. One of the best ways to find a reliable broker or custodian is by doing research on the internet. For tax years 2015 and 2016, the McNultys hired a CPA to produce and file their income tax returns. Gold IRAs are backed by physical precious metals, unlike other retirement investment options, which store paper assets. By placing precious metals in an IRA, you can thus potentially preserve your buying power and help safeguard your money from the effects of inflation.

Learn More

Click the links above to request a free investors guide from any or all of the silver companies. Gold IRA could be a potential way of investing that is right for you. If you have an existing IRA, you can open a new account and initiate a direct transfer using a transfer request form. Welcome to Dollar Loan Center, your Community Short Term Lender. Noble Gold is a leading provider of gold and silver IRAs, offering customers a secure and reliable way to invest in precious metals. A Precious Metals IRA requires special handling to set up and manage. Consider the tax implications before making any decisions. Sign up for timely AGE Investor Alerts and AGE Gold Commentaries. Their customer service is also top notch, providing quick and helpful responses to any questions. These companies will help you throughout all steps involved in purchasing gold as part of your IRA. The custodian will provide you with consistent reporting on your precious metals IRA and earnings. When it comes to customer service, Goldco takes great pride in offering high levels of responsiveness and reliability from start to finish. Their TrustLink page reveals almost 300 five star reviews from verified customers. However, there are also some risks associated with Gold IRAs that potential investors should be aware of.