Gold Investors Turn to Gold IRAs Amid Economic Uncertainty

Additionally, many institutions offer digital banking solutions so you can access information about your account online without having to worry about someone tampering with paper records or documents stored offline. It supports rollovers from several accounts, including traditional IRAs, Roth IRAs, thrift savings plans, 401ks, 403bs, and 457 plans. The best gold IRA companies understand this need and typically create materials that are easy to understand so investors can enrich their knowledge. If you have too much in gold, you’ll miss out on the growth opportunities from other investments. For comprehensive guidance on U. After all, the precious metals IRA https://www.reviewjournal.com/bp/business/top-10-gold-ira-companies-secure-your-future-best-ira-accounts-for-gold-investing-in-2023/ company that you choose will be in charge of facilitating the security of your financial future. When it comes to investing in gold IRA companies, there are a plethora of options available in the market. Many precious metals IRAs own a mix of gold and silver.

Is IRA Gold Safe

However, it’s important to note that managing a precious metals IRA can be complicated and costly. Gold has been traded for thousands of years, long before the stock market or the internet were invented. An IRA is an individual retirement account that allows you to set aside money for retirement on a tax deferred basis. In times of economic turbulence, gold investing can be an attractive option. If you don’t hold these assets in an IRA, there’s no need for you to bother with depository needs and complicated rules. Currently, none of the IRA companies on the market are permitted to handle precious metal IRAs. Otherwise, it would be considered a distribution and have tax implications. Traditional IRAs are subject to federal and state taxes, while Gold IRAs are exempt from both. Also, we highly recommend that you speak to your financial advisor before making an investment decision.

Top 6 Gold IRA Companies Of 2023

Experience Unparalleled Quality with GoldCo Try Today. There are many things to consider before making a Silver IRA investment but start by looking at your financial situation and the long term goals you have in mind. IRA Amount Options: $500, $1,000, $2,500, $5,000, $10,000, $25,000, $50,000, $100,000. Offers competitive pricing and transparent fees. Buying physical gold also gives you a feeling of security. Additionally, they must be in their original packaging and in excellent condition to be eligible for a gold IRA. These aren’t just a cost of investing, but they also reduce your investment earnings. You’ll hear about the silver IRA, palladium IRA, or platinum IRA, and these are all interchangeable for simple matters. In summary, investing in a gold backed IRA can provide investors with a secure and stable investment option for their retirement savings. Investors who also enjoy collecting will find a wide array of IRA approved gold, silver, platinum, and palladium products with which to fund their precious metal IRAs through the American Precious Metals Exchange APMEX. Investing in gold is a popular choice for retirement accounts, and many people choose to add gold to their IRA.

4 Birch Gold Group

Sorting out the information from many websites can be intimidating and take a long time and effort. Finally, investors who don’t want to try to identify the best individual gold mining stocks can consider buying shares in gold ETFs, which are more convenient and cost effective options for investing in gold stocks. The IRA custodian for gold must be chosen carefully, as it is responsible for the safekeeping of the assets and the maintenance of the account. Investing in gold for retirement through a gold IRA rollover can provide diversification, an inflation hedge, a potential store of value, and potential for growth. Secure Your Financial Future with Birch Gold Group’s Precious Metals Investment Options. One of the co founders of Advantage Gold, a global leader in precious metals, is Kirill Zagalsky. Look for factors such as customer service, ease of account setup, and transparency. Self directed IRAs are a type of retirement account that allows you to invest in alternative assets.

$10 Indian Certified MS63 Dates/Types Vary

Unlock Your Financial Potential with Advantage Gold. If you buy gold or silver through Augusta Precious Metals, it comes with ‘life time support’. Goldco has been a trusted name in the gold IRA industry since 2006. A Gold IRA, or Individual Retirement Account, is a specialized investment vehicle that allows individuals to save for retirement by holding physical gold, silver, or other approved precious metals. >> Read More: How to start investing in a gold IRA. The company has over 20 years of experience buying and selling gold, silver, platinum, and palladium. Silver and Palladium IRA: 4. Secure Your Future with Augusta Precious Metals.

Found the story interesting?

Second, by investing in gold within a diversified investment portfolio, you can protect yourself from market volatility. Again, your purchases will not be physically stored by the precious metals IRA company. You may roll over an existing retirement account IRA, 401k, TSP, pension to your self directed IRA. What Is The Tax Rate For A Gold Ira. In addition, precious metals offer protection against inflation and other negative events during turbulent times. That’s why consulting with a financial advisor, or lawyer is recommended before deciding on your IRA withdrawals. Following gold, silver is the second most well known precious metal commodity. They want to make sure you get the information you need to make the best choice for your future. Their expertise in gold backed investments, customer service, and security measures make them a standout in the gold IRA industry. If you really want to keep some gold at home, there are a couple of options. Its prices change depending on supply and demand, investor behaviors, and the amount of the product in bank reserves. When it comes to investing in gold and silver IRAs, each of these brands provides customers with a comprehensive range of services to help them make the most of their retirement savings.

Birch Gold: Summary Best Gold IRA Companies

For many people, retirement savings are the most important investments they make. Red Rock Secured is a reliable investing company in which they prioritize security, transparency, and consumer pleasure. The precious metal products need to issue from a national government or other certified manufacturer or refiner. FOURTH QUARTER AND FULL YEAR 2022 FINANCIAL AND PRODUCTION SUMMARY. With Lear Capital, you can embark on a path to financial prosperity, backed by their exceptional services and commitment to excellence. We publish data driven analysis to help you save money and make savvy decisions. A third firm quoted a range of 4% to 33%, which is, well, wide. Then, Noble Gold will connect you with a precious metals IRA custodian. It allows investors to diversify their retirement portfolio and potentially increase their retirement savings. You will need to put a portion of your savings into assets that can maintain their value even under the worst economic conditions. IRS approved depositories will charge approximately $150 annually to store your gold, and you’ll pay more if you want separate storage. Their inventory contains over fifteen coins from government mints worldwide.

The New Outlook Foster the Thought in You

Unlock Your Investment Potential with Birch Gold Group. Noble Gold’s team are experts in the field, offering a wide range of gold IRA options to their customers. It offers a wide selection of precious metals IRAs to choose from. Once you have chosen the best gold IRA companies, you can complete the Rollover process. This ensures your information is kept confidential and protected from any unauthorized access. The company is dedicated to helping their customers make informed decisions when selecting a precious metals IRA, and their customer service team is available to answer any questions. Join our FREE email newsletter to receive special offers, weekly metals market recaps, must watch videos, and more.

Can I Cash Out My Gold IRA?

It is also crucial in industries such as electronics and dentistry. The company offers a wide range of options, including self directed IRAs and 401k rollovers. Investing in gold can feel challenging, especially for new investors. They offer competitive pricing, and their buyback program makes them an excellent choice for small investors. News articles that mentioned them have also been reviewed. For example, there is no setup or transfer fee, and the company will pay your storage fees for up to three years. Invest in vaulted precious metals through an online account without the hassle of holding and storing your assets. With their setup fees clocking in just slightly lower than Lear Capital, Augusta Precious Metals is another top pick for investors who want transparent pricing when it comes to gold investment companies. You get a mortgage and / or a loan from other people and of course pay the interest. Your precious metals will likely be more secure in one of these facilities than they would be at your home or in another self storage option. Unlike some competitor gold IRA firms, Birch lacks a blog and diversified investing articles. Experience the Power of Gold Alliance Now Transform Your Business Today.

Gold:

They will work with you, in one on one webinars with Ive League graduates, to make sure you know as much as possible about Precious Metals investing–before they ever ask for a dime. With over 10 years of experience in the industry, GoldBroker has a deep understanding of the precious metals market and provides clients with a secure and reliable alternative for their retirement savings. Product Type: Precious MetalsOwner: Trevor GerzstRating: 4. For this reason, lots of investors turn to gold individual retirement accounts gold IRAs. You can, however, make a selection based on your preferences. However, there are other types of IRAs that may be better suited for certain situations: Roth IRAs allow you to contribute after tax dollars but then withdraw earnings tax free in retirement with some restrictions,. Right now, the only way to avoid paying taxes on gold is by purchasing it through your 401k plan or IRA.

How Much Gold or Precious Metal Coins Do I Need To Retire?

American Hartford Gold Group offers a full suite of services to help individuals and families invest in gold and silver IRAs. The company’s commitment to providing top notch gold investment services makes them a great choice for those looking for an IRA custodian for gold. Gold And Silver IRAs: You can purchase a wide range of gold coins through Goldco. The benefits of investing in gold as well established. As a result, when the dollar’s value falls, the cost of gold often increases. The solution is passive income. Advertising Disclosure. Most gold IRA companies will buy back precious metals you bought from them, but buybacks are generally at the wholesale price, which often is around 30% lower than prevailing retail gold prices.

Recent Posts

Have you ever heard the phrase, “You shouldn’t keep all your eggs in one basket. Like with any investment options, there are pros and cons. They’ve lauded the team’s willingness and ability to provide support and assistance when needed. These fees may be a one time charge, or they may be assessed on a recurring basis. Very few companies maintain their own storage depositories, so most partner with third party depositories approved by the IRS for the secure storage of precious metals held in IRAs. They will also provide you with guidance and advice on the best way to invest in gold and other precious metals. SingSaver is located at Eon Shenton, 70 Shenton Way, 18 08, Singapore, 079118.

The Complete Guide on How to Move 401k to Gold Without Penalty

And if you’re unhappy with your purchase for whatever reason, the company also has a no fee buyback program that lets you sell your gold back to Lear Capital at the current market price. You won’t get any shortcuts or end arounds. The company offers self directed gold and silver IRAs and offers customers various funding options. The company provides clients with the resources they require to come up with a diverse investment portfolio. That’s why Goldco is willing to buy back your gold coins at the highest price with their buy back guarantee. Better Business Bureau “Noble Gold Investments. Invest in Precious Metals with Lear Capital and Enjoy Financial Security. You may take advantage of various tax benefits when you convert an existing IRA or 401k into a silver IRA. Experience the Power of Gold Alliance: Invest in Your Financial Future Today.

Subscriptions

IRA terms of 3 7 years. If you choose to diversify your retirement portfolio and protect yourself against economic volatility, gold IRAs may be a solid choice. Sprott Physical Bullion Trust unitholders have the right to redeem for physical metals on a monthly basis, subject to meeting the minimum redemption amount. If you choose to ignore this rule and keep your gold at home, your gold will qualify as a distribution, meaning that you may face a 10% tax penalty. Some companies offer a four figure minimum investment, while others demand a five or six figure minimum investment. In addition, the website also includes a video resource library filled with helpful videos from Delvyn Steele, a Harvard trained economist. Ryan SullivanInvestment Advisor. Expand your investor knowledge with articles, whitepapers, practical guides and tons of other educational resources.

Learn More

We’ve seen a lot of economic variability in the last two years. ☑️ Free shipping on any order over $10,000. While the choice to work with one company over the other may differ depending on the investor’s need, the best gold IRA company should meet the following benchmarks. Furthermore, the setup is quick, plus the company has experienced professionals who are ready to help you understand each process. On top of that, the firm still has an A+ rating from the renowned Better Business Bureau. A victory in Karnataka may aid the Congress party in its efforts to form an Opposition front for the 2024 parliamentary elections. This basically means that you don’t have to pay fees that are typically associated with the purchase of gold coins or bars. In addition, they need to be in excellent condition. Advantage Gold is a trusted precious metals IRA firm able to facilitate the tax deferred purchase of your precious metals. It also provides you with other information about the company. They give Birch Gold Group an A+ rating with 4.

Ranked 4 of 25

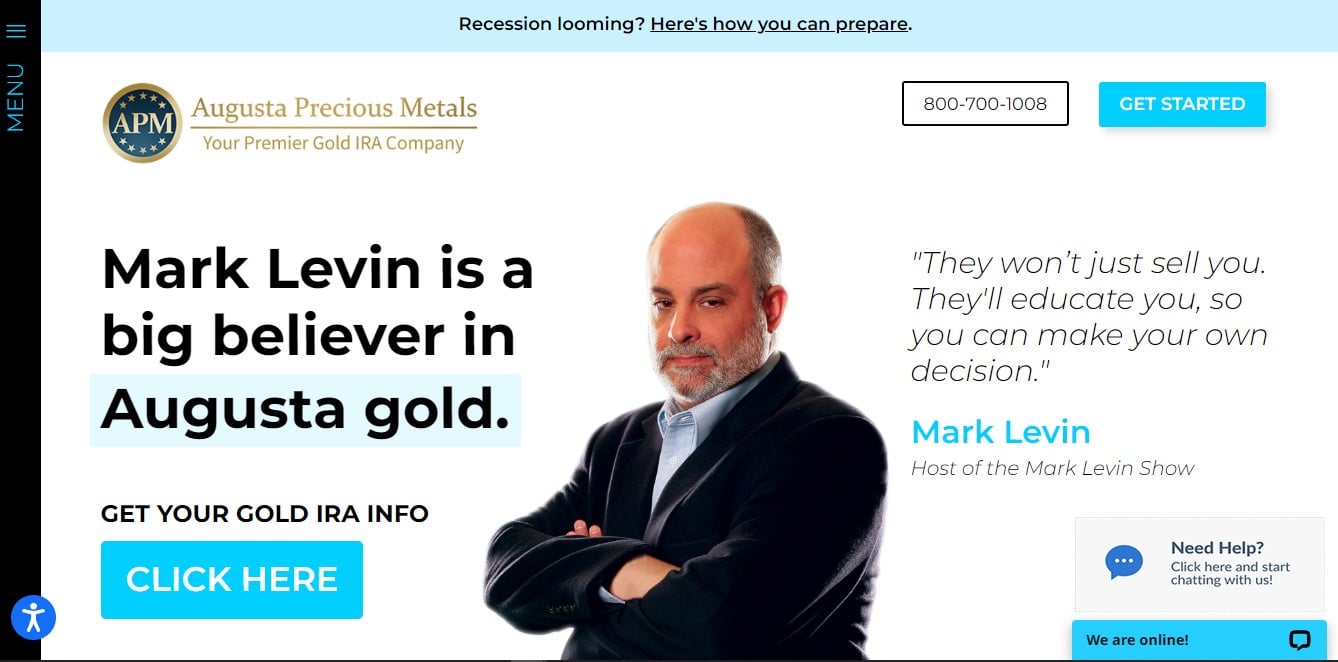

Augusta Precious Metals has built its reputation for integrity and transparency since it was established back in 2012. Exceptional level of customer service: 1000s of top ratings, 100s of customer reviews, and endorsements by conservative talk show hosts and hall of fame quarterback Joe Montana. If the funds originally rolled over were from a Roth IRA you won’t owe taxes on the distribution. Deccan Herald 3 weeks ago. They offer a wide range of services, from gold and silver IRA rollovers to buying and selling precious metals. Like Goldco, Augusta has a flat setup fee of $50. Mint, which are 22 karat purity or. Many businesses will tell you the truth about these benefits and how to obtain them. Investors should do their due diligence before committing any money to purchase gold and other precious metals. The gold backed IRA information provided by these companies was found to be comprehensive and up to date. Experience the Brilliance of GoldCo: Shop Now for Quality Jewelry and Accessories. A+ Accreditation with BBB. Your precious metals IRA is connected to an IRA custodian that manages the entries of the logbook and a depository vault where the actual assets are stored. Find your investor profile — with the company that best matches it — below.

Benefits

RC Bullion is known for its expertise in gold investments and provides a secure and reliable way to diversify individual retirement portfolios. Oxford Gold Group is an excellent company for new gold IRA investors because of the company’s educational tools to help beginners get up to speed. In fact, this approach is what hooked their celebrity client ambassador. If you want to work with a company that’s been getting it right for a long time, then this will be a good fit. You can also request to have gold directly delivered to you. 1 Submit a refund request to the aforementioned recipients. China’s nickel imports from Indonesia are shifting fast to reflect policy changes and new ambitions. It has won several awards for the quality of services offered over the years.